Earn upto 10-14%

Potentially higher returns if all repayments are paid on timeRepayments

Enjoy regular earning as borrower makes repaymentsTransparency

Access detailed borrower profiles for informed decisions

Data as of August, 2025

How does it works?

Lend money with no extra charges or fees

Review & approve detailed borrower profiles

Borrower repayments are credited to your bank A/c

What is MobiKwik XTRA?

MobiKwik Xtra is brought to you in partnership with Transactree Technologies Private Limited (“Lendbox”) which is a RBI-regulated NBFC - Peer to Peer Lending Platform.What is P2P Lending?

Peer to Peer(P2P) Lending allows participants to lend and borrow money, cutting out the traditional bank in between.

With technology intervention and smart algorithms, P2P lending companies are able to give small ticket loans for shorter tenure to borrowers with higher likelihood of repayment. Investment of as small as Rs 10,000 can be distributed to more than 100 borrowers with the use of technology hence diversifying risk. The interest earned from borrowers is distributed back to the lenders.

How to get started?

Download MobiKwik App

Complete the KYC registration process

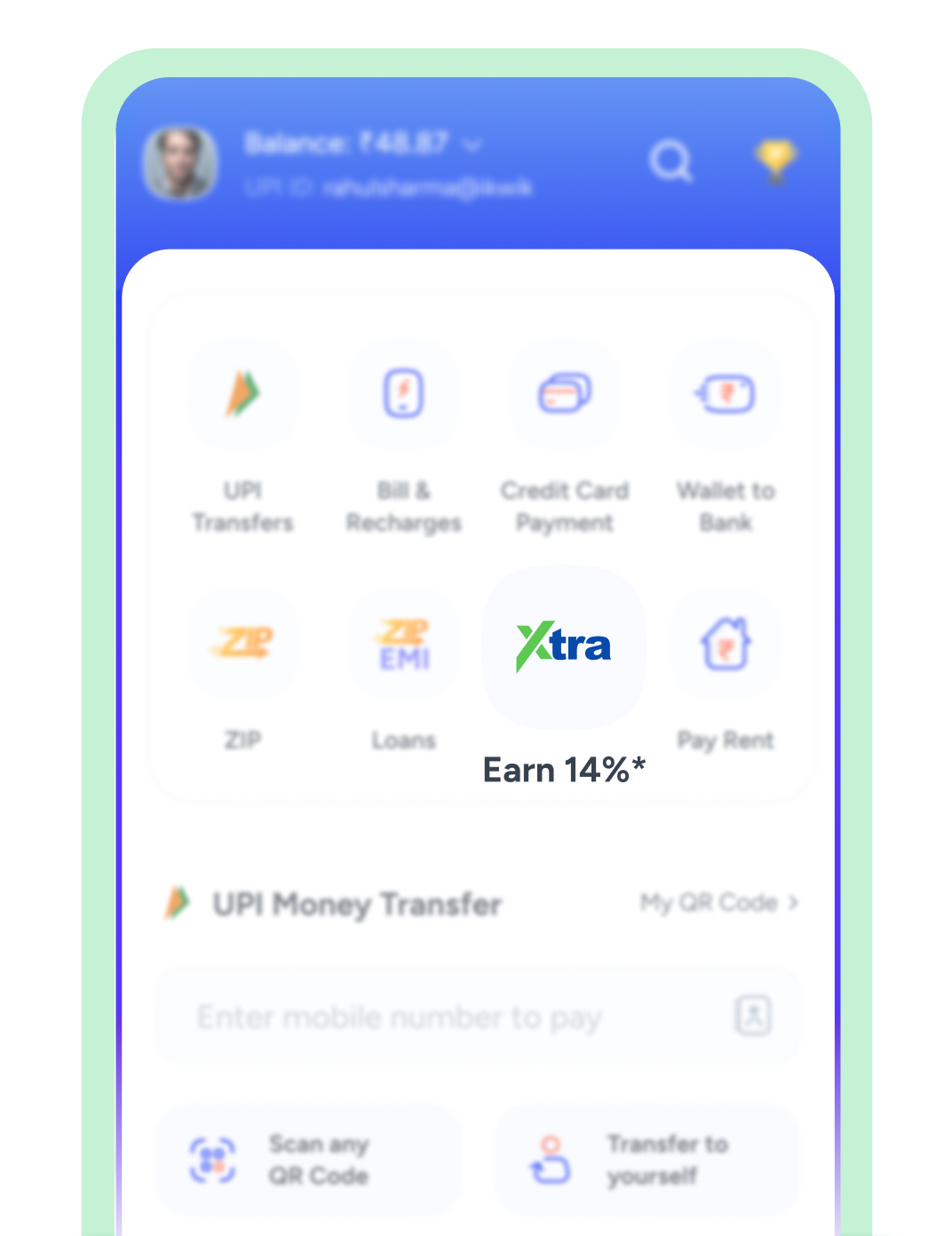

Click on Xtra

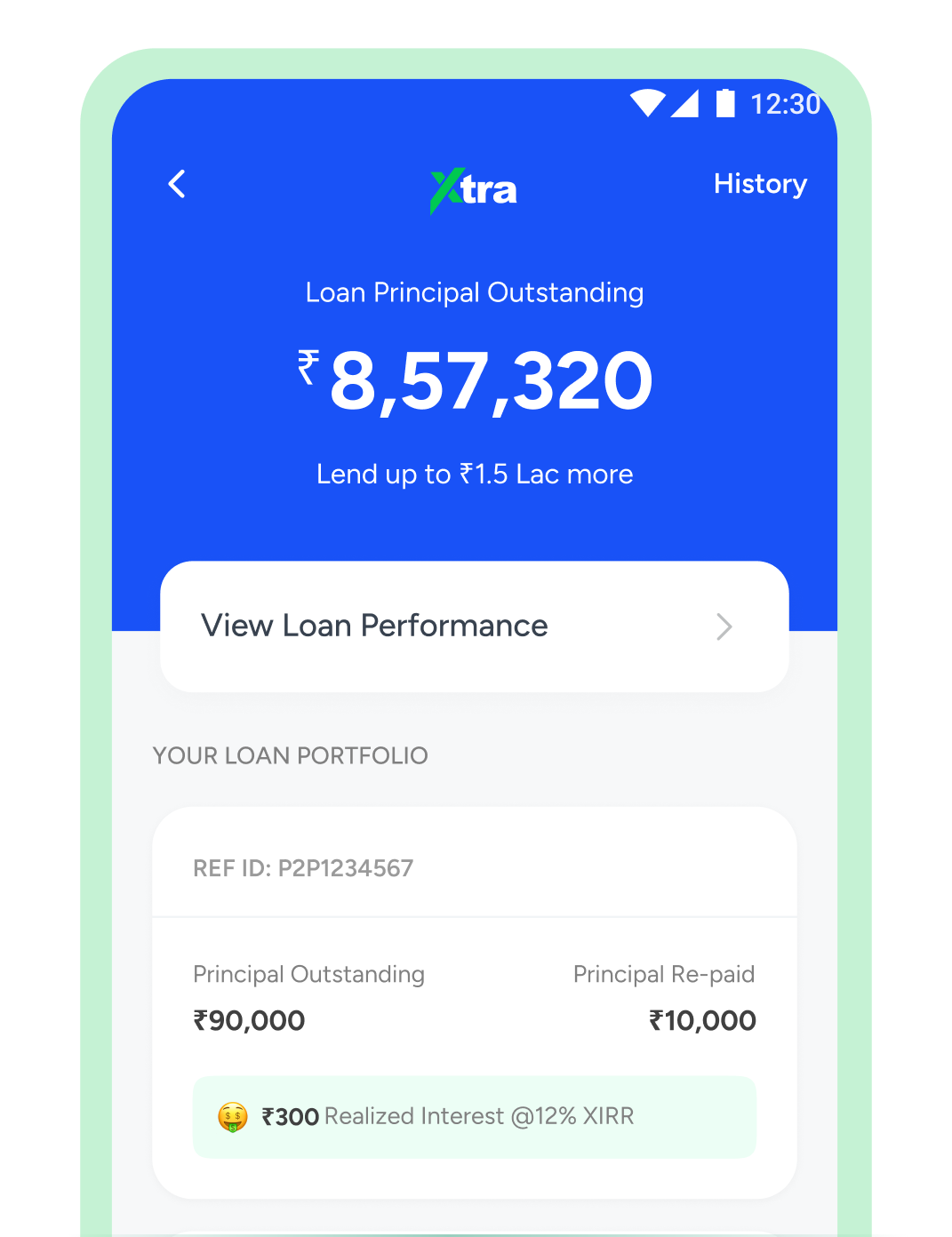

Start your lending journey and earn high returns

Frequently Asked Questions

-

What is MobiKwik Xtra?

MobiKwik Xtra is brought to you in partnership with Transactree Technologies Private Limited (“Lendbox”) which is a RBI-regulated NBFC - Peer to Peer Lending Platform. Xtra offers you the opportunity to earn upto 14% XIRR by lending directly to creditworthy borrowers. MobiKwik serves solely as a platform facilitating the product of Xtra and expressly disclaims any and all direct or indirect liabilities or claims in this context and bears no obligation or responsibility whatsoever. Neither MobiKwik nor any of its affiliated companies shall be part of the claims or disputes related to funds invested with Lendbox, or any matters concerning investor eligibility, withdrawals, repayment or issues pertaining to the usage of the Lendbox platform. For avoidance of doubt, it is also hereby clarified that RBI does not accept any responsibility whatsoever for the correctness of any of the statements or representations made or opinions expressed by the NBFC-P2P and does not provide any assurance for repayment of the loans lent on it.

-

What is P2P lending?

Peer to Peer(P2P) Lending allows participants to lend and borrow money, cutting out the traditional bank in between. With technology intervention and smart algorithms, P2P lending platform operators are able to facilitate small ticket loans for shorter tenure to borrowers with higher likelihood of repayment. As an illustration, loaned money as small as Rs 20,000 can be distributed among more than 20 borrowers with the use of technology hence diversifying risk. The interest earned from borrowers is distributed back to the lenders.

-

How will my money be deployed between different borrowers?

Lendbox, at its sole discretion hereby has agreed to undertake credit assessment and risk profiling of the borrowers using several data points with respect to income and expense behavior of the borrowers before disclosing the right borrower profiles to you, assisting you in lending your money to creditworthy borrowers. Your funds will be split into chunks as small as Rs.100 and distributed between a number of borrowers. This helps in mitigating risk and diversifying your loaned money.

-

What are the risks with P2P Lending?

As with any lending product, there are some risks associated- the biggest one being that a borrower doesn’t repay on time or pays back only partially even after repeated follow-ups. Lendbox and MobiKwik undertake KYC of the borrower and only approve the borrowers who pass Lendbox’s credit assessment policies. Your loaned amount is also diversified across multiple borrowers to minimize risk as much as possible by Lendbox, and all of the borrowers have to sign the legally binding loan agreement. In case of a default, recovery efforts are made by Lendbox and MobiKwik through the collection agencies to follow up and recover missed payments on your behalf. Lendbox or MobiKwik cannot guarantee repayment of the amount lent through the P2P platform and there exists a likelihood of loss of the entire principal amount and under no circumstances shall MobiKwik be liable to make repayment of the amount on behalf of defaulted borrowers.

-

Is my money loaned through Xtra safe?

We understand that your safety is a top priority when it comes to your money. Xtra is a P2P Lending product, which means your money is lent directly to borrowers. While P2P lending does carry some level of risk, several measures are taken to mitigate this:

- Rigorous Borrower Screening: Our NBFC-P2P partner, Lendbox conducts thorough credit checks and assessments of borrower profiles before allowing them to access funds. This helps to keep defaults in check.

- Diversification: Your money to be lent out is spread across multiple borrowers, which minimizes the impact of default from a single borrower.

- Regular Monitoring: Lendbox continuously monitors the performance of loans and the financial health of borrowers to ensure ongoing stability and take required measures to reduce delay in repayments through collection efforts.

While none of the lent money is entirely without risk, our NBFC-P2P partner is committed to managing and mitigating risks. -

When and how will I get the money back? What is the repayment timeline?

Borrowers are expected to repay EMIs on the 5th of every month. There can be cases of delay in EMI payment or prepayment of EMI by borrowers. In all scenarios, as & when the borrowers repay, the funds will be auto-credited to your linked primary bank account on the next working day of the credit of funds from your mapped borrowers, without you having to initiate withdrawal to bank. In some scenario the bank account transfer may fail if your default bank account number, IFSC, & holder name is not correctly updated. We therefore request you to review your default bank account details & ensure they are correctly updated on the app. Please don’t hesitate to contact our support team at xtra@mobikwik.com incase of any queries

-

Was it necessary to apply these changes to existing money lent on Xtra, or could they have been limited to new loans?

Based on a regulatory clarifications received on 16th August 2024, certain features of the product have been specifically disallowed effective immediately including anytime/flexible withdrawal facility. All repayments will now be credited directly to lenders as and when borrowers make their payments. As a result, these changes apply to both existing and new loans on Xtra.

-

Why was my consent not taken for the change in Xtra?

As the clarifications and updates are effective immediately from 16th August, changes to the existing loaned amount have been made accordingly whereby withdrawals now require to be linked directly to borrower repayments. Rest assured, borrower repayments—including both principal and interest—will be auto-credited to your primary bank account on the next day of credit of funds from borrowers.

-

Has this change been applied to all customers?

We would like to confirm that the changes to Xtra are made equally applicable to all existing and new customers of Xtra without any exceptions for any individual lender as these have been made in line with the regulatory guidelines

-

Why were there no notifications from MobiKwik about the changes?

Once the necessary changes were made to Xtra by our NBFC-P2P partner “Lendbox” in accordance with the recent regulatory clarifications, MobiKwik has pro-actively provided regular notifications via E-Mail, and we are also responding to any queries raised by our customers on our customer care support and social media channels.

-

Where is my existing Xtra Flexi or Plus amount?

Your Flexi & Plus outstanding principal has been merged into a combined single loan ID. You will be able to see the details of the borrowers in your portfolio along with their repayment schedule. As and when these borrowers pay their EMIs, repayments will be credited to your linked primary bank account on the next day. You will only earn interest on the outstanding principal amount.

-

I made a new payment in Xtra after 16th Aug’24. What happened to that amount?

You will be required to explicitly approve borrowers then only this money will start generating returns. This amount is shown in the Funds Added section on the dashboard from where you can initiate borrower approval or withdraw them to your bank account.

-

Who all can lend on MobiKwik Xtra? Can NRIs lend?

As per RBI’s directives, an entity or Individual with valid KYC documents ( valid PAN Card, Address Proof, Indian Bank Account, Email Id & Mobile No.) can lend via a Peer-to-Peer Platform. Eligible Entities include:

NRIs can also lend money in Xtra via their NRO bank account.- Individual (18 years old or above)

- HUF

- Corporate (Incorporated under Indian Companies Act or RBI Listed Finance Companies)

- Partnership Firm

- Limited Liability Partnership (LLP)

- Body of Individuals

- Society

- Artificial Body

-

Which documents do I need to start lending money in Xtra?

You are required to undertake the KYC process as required by lendbox from time to time and you may have to verify your PAN and identity proof as per the applicable guidelines issued by RBI.

-

How much money can I lend on Xtra?

You can start lending money with a minimum of Rs. 10,000 and maximum upto Rs. 10 lacs across all P2P platforms. If you wish to increase your limit to Rs. 50 lacs, you can request for account upgrade on the app. As per RBI guidelines, you can loan maximum Rs. 10 Lacs across all P2P platforms. In case you want to lend an amount more than Rs.10 lacs and upto Rs. 50 Lacs you will have to produce a networth certificate from a practicing chartered accountant and submit it to Lendbox.

-

How will I earn returns on Xtra?

Once you add funds, you will be shown a detailed list of borrowers with their credit score, age, gender & loan amount required. You will be required to review & approve these borrowers. On approval the money will be disbursed to the approved borrowers in 1 working day. If the loans are sanctioned to the borrower on or before 20th of the month, you will start receiving repayments from next month otherwise from next to next month. As & when the borrowers pay EMI on the loaned amount, the repayment is credited to your account with some principal as well as interest component. Your principal decreases with each repayment & Interest is earned only on the remaining principal. Each of your disbursed loans will have a repayment schedule based on which you will receive funds into your account.

-

How do I choose the borrowers to whom the funds are being deployed?

Lendbox undertakes credit assessment and risk profiling of the borrowers based on various parameters like risk score, credit score, income history, location, loan amount, loan tenure, ROI etc. and creditworthy borrowers are shown to you on the app. You have an option to either approve all the borrowers or decline. In the event you decline to approve the borrowers, your funds are visible on the app in the undeployed funds section and you can re-initiate borrower approval or withdraw your funds back to your bank account.

-

What are Undeployed Funds?

Undeployed funds is when you made the payment but did not approve the borrowers to whom the funds will be lent/disbursed as loans. The funds in this bucket are not deployed to borrowers, so not earning interest. You can tap on “Lend & Earn” to deploy these funds to borrowers if your loan limit is available or withdraw them to your primary bank account.

-

What is Repayment section?

When borrowers repay their loan as principal and interest, it will be shown in this section. This amount cannot be redeployed to new borrowers & will be auto-credited to your primary bank account the next day of credit of funds from borrowers. This amount will be removed from the Repayment section, once transferred successfully to your primary bank account. In some scenario the bank account transfer may fail if your default bank account number, IFSC, & holder name is not correctly updated. We therefore request you to review your default bank account details & ensure they are correctly updated on the app.

-

What happens when a loan is re-paid early by the borrowers?

In case loans are closed early by the borrower by paying full loan amount, repayment schedule will get impacted, expected interest amount might get reduced & principle will be repaid in early.

-

Why am I getting repayment less than the expected range?

Repayments are subject to the loan EMI paid by the borrower. In the scenarios where borrowers are defaulting on the loan, paying late EMI, paying less than the expected EMI or closing the loan early; repayment values can go below the expected range. As we mentioned earlier in FAQ’s P2P lending is subject to risk (Please go through this FAQ - What are the risks with P2P Lending?)

-

Are my earnings taxable? Will tax be deducted when I withdraw my earnings?

Interest income earned is taxable as per your income’s tax slab and is classified under ‘Other income’. Tax will not be deducted at source, i.e., we will not deduct tax when you withdraw your money. Transactree Technologies Pvt Ltd (Lendbox) shall issue an interest certificate declaring the interest earned by the user during each financial year, and this will be available on Xtra dashboard for the user to download. Paying the applicable tax on income earned is the user's responsibility and MobiKwik or Lendbox is not liable for any default on the same.

-

Why does Xtra require my bank account details?

For security purposes, you are required to link a bank account where the bank holder’s name and Xtra KYC holder’s name should match. This same bank account should be used for making payments to add funds for lending it to the borrowers and receiving repayments as and when borrower’s pay their EMIs. You can change your bank account, however, any change in bank account will take a minimum 24 hours for update.

-

I am getting an error while adding my bank account.

You see an error because online verification of the bank account holder's name has failed against your KYC documents available in the system. Please share a copy of your self-attested bank account statement or cancelled cheque leaf with the name of the account holder printed on it along with your KYC documents to xtra@mobikwik.com for our team to verify and update your bank account details.

-

What payment methods are accepted on Xtra?

You can make payment via UPI, Netbanking or IMPS/NEFT/RTGS based bank transfer. Payment via credit card is not allowed by RBI for P2P lending. Via UPI you can transact for up to Rs. 1 Lac only.

-

How to use IMPS/NEFT/ RTGS bank transfer mode of payment for Xtra?

For every user Lendbox provides a unique system generated Virtual Bank Account Number. Add this account as a beneficiary in your primary bank account and make IMPS/NEFT/RTGS based transfers. Thereafter, input the transaction reference number/ UTR of the successful bank account transfer in the payment flow. These funds will reflect in “Undeployed Funds” section in upto 30 minutes. From the undeployed funds section, you can approve the borrower list & deploy the funds to start generating returns. Please be very careful while adding the account number and sharing the transaction details/UTR as any inaccuracy will lead to the failure of automatic mapping of the amount to your Xtra account and will need to be manually resolved after you share the correct details. This manual mapping effort may take up to 7-10 business days.

-

Money has been debited from my bank account but it says that payment failed

Any amount debited from your bank account in such a scenario will be automatically refunded back into the source account within 5-7 working days from the date of payment failure. If it doesn’t happen, you can raise a ticket on xtra@mobikwik.com or support@lendbox.in along with reference transaction ID

-

I’m unable to make payment via UPI.

If you have newly setup or restored UPI on MobiKwik, there is a cooling period of 24 hours set by NPCI wherein you will be able to transact for upto Rs. 5000. After the initial cooling period, you will be able to transact for upto Rs. 1 Lac per day per bank account via UPI. If you have exhausted your UPI transaction limit of Rs. 1 Lac per day per bank account you will not be able to transact on Xtra.

-

I’m unable to make payment via netbanking.

This could happen if the amount you are trying to lend is more than the third-party transaction (TPT) limit set by your bank account or if you have not registered for a TPT facility with your bank. In both cases, you can connect with your bank to resolve this.

-

I’ve transferred funds via IMPS/RTGS/NEFT but my portfolio is not updated.

It takes up to 30 minutes for Lendbox to update the portfolio once the correct transaction details/UTR are shared by you. If your amount is still not updated in the undeployed funds section please reach out to us at xtra@mobikwik.com with your transaction reference number and proof of transaction from your bank account. Successful transaction screenshot or a debit transaction from your bank statement is treated as a proof of transaction for our team to help resolve your issue.

-

What happens when my portfolio value exceeds Rs. 10 Lacs and account is not upgraded?

In case your principal outstanding value exceeds Rs. 10 Lacs, the amount over and above the allowed limit will move into the “Undeployed Funds'' section on the app. This amount will not generate you interest and can be withdrawn to your bank account. Alternatively, you can upgrade your lending limits to Rs. 50 Lacs and lendthe additional funds to start generating interest. However, this is subject to additional document requirements as required by RBI and Lendbox from time to time.

-

Who can request for an account upgrade?

Any user whose total loaned amount on Xtra is equal to or above Rs. 8 Lacs will be provided an option to upgrade their account to increase their maximum lending amount to upto Rs. 50 lacs. For this, you will be required to furnish a certificate as proof for your networth above Rs. 50Lacs as per RBI guidelines.

-

What is a net-worth certificate?

A net-worth certificate is an official document generated by a practicing Chartered Accountant certifying that an individual has a certain minimum net value (Assets minus Liabilities)

-

What is the process of account upgrade?

You can apply for account upgrade by submitting asset documents that show a minimum net worth of Rs. 50 Lacs. Documents such as bank statements, investment portfolios, NSDL statements, etc that show assets belonging to you are treated as an asset document. Once your documents are received, they will be reviewed by a practicing Chartered Accountant (CA). The CA after verifying and approving the documents generates an official net worth certificate, post which your lending limit is increased to Rs. 50 Lacs. If the documents are not approved, you will be required to submit the documents again. In both the scenarios you will be able to see the status of your account upgrade request on the app.

-

How safe are my documents?

The documents you submit as proof of your net-worth will only be used to review and upgrade your account. During this process, they will be encrypted with limited access to the reviewers, in short, your documents will be completely safe and will not be used for any other purpose.

-

What happens if I transfer funds above my investable limit via IMPS/NEFT/RTGS into Xtra?

In case your portfolio value exceeds Rs. 10Lacs with the additional transaction, the entire amount of the transaction will move into the “Undeployed Funds'' section on the app. This amount will not generate you interest and can be withdrawn to your bank account. Alternatively, you can upgrade your lending limits to Rs. 50 Lacs and lend the additional funds to start generating interest.

Please note: Transactree Technologies Pvt. Ltd (Lendbox) is an NBFC-P2P lending platform registered with the RBI. However, RBI does not accept any responsibility for the correctness of any of the statements or representations made or opinions expressed by the NBFC-P2P and does not provide any assurance for repayment of the loans lent on it.