Tech Solutions for all Businesses

- Innovative, Sleek & Secure Devices

- Best in class transaction success rate

- Solutions to grow your business manifold

More about MobiKwik

MobiKwik is a mobile wallet and financial services platform that allows users to send & receive money, pay businesses and utility bills, shop online or at stores, and get access to financial products like instant digital loans, make instant settlements towards credit card bills invest in digital gold, mutual funds & fixed deposits, and get extraordinary returns up to 14% p.a on via P2P Lending on Xtra.

Our latest offering Pocket UPI gives users the power to make UPI payments without the need to link their bank accounts.

How can I download the MobiKwik app?

You can download the MobiKwik app from the App Store (for iOS) or Google Play Store (for Android).

How to create a MobiKwik account?

- Open your MobiKwik app

- Tap on ‘Create A New Account’

- Enter the mobile number that you want to use for MobiKwik and your email address.

- Tap on ‘Create a New Account’

- Enter the OTP that you receive on your mobile number and click on ‘Submit’

- Enter your First Name, Last Name, and DOB

- Click on ‘Create Account’

- Your account has been created

How to use MobiKwik?

MobiKwik offers a wide range of services including UPI payments, online recharge, bill payments, shopping online or at stores, paying businesses through any QR or UPI ID, and more. To take advantage of India's fastest financial technology services, simply link at least one of your bank accounts to your MobiKwik account.

How to transfer money from MobiKwik to a bank account?

Transfer money from MobiKwik to a bank account by following these steps:

- Open your MobiKwik app

- Select 'Send Money to Bank'.

- Enter the Recipient name, account number, and the IFSC code.

- Enter Amount

- Confirm the transaction by clicking 'Confirm payment'.

- Your transfer is now complete.

Please be aware when transferring money from your MobiKwik wallet to a bank account.

How can I complete the KYC process on MobiKwik?

To fulfill your KYC requirements on MobiKwik, proceed as follows using the MobiKwik app:

- Go to the 'My Profile' section.

- Select 'Complete your KYC'.

- Choose 'Start Video KYC'.

- Click on 'Start Journey'.

Ensure you have a valid identity proof document such as an Aadhar card or PAN card readily available.

How to add money to the MobiKwik wallet?

To deposit funds into your MobiKwik wallet, simply follow these simple steps:

- Open your 'Profile'.

- Click on 'Add money'.

- Enter the desired amount and click on 'Add Money'.

- Select your preferred transaction method - bank account, debit card, credit card, net banking, or UPI.

- Enter the necessary account/card details and tap 'Pay Securely'.

- Input the OTP received on your registered mobile number.

- Your wallet will be successfully topped up with the deposited amount.

What is the process for making a UPI payment using the Mobikwik App?

You can now make all your UPI payments via the MobiKwik Wallet without linking your bank account

- Open the MobiKwik app

- Scan any QR code or Enter any phone number or UPI ID

- Input the payment amount

- Select Pocket UPI from the payment options to pay using your wallet balance

- You can load your wallet with up to ₹200,000 using your credit card, debit card, linked bank account or any other mode

- You can also pay using your linked bank account

- The payment is then sent to the recipient

Is MobiKwik safe to use?

Yes, MobiKwik employs advanced security measures to safeguard your transactions and personal information. We use encryption and secure protocols to ensure the security of your data.

Which bills can I pay using MobiKwik?

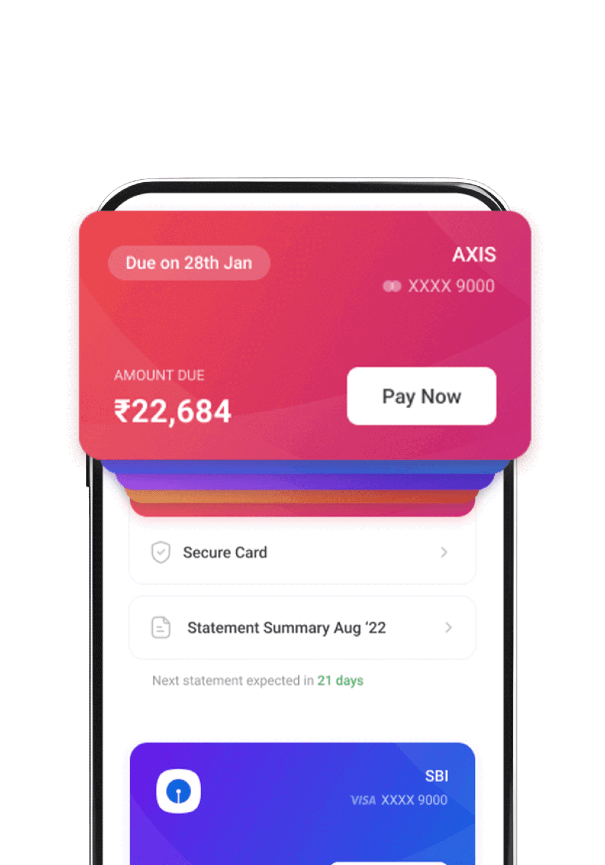

You can pay various bills, including credit card bills, electricity bills, and other utility bills using the MobiKwik app.

How can I recharge my prepaid mobile using the MobiKwik app?

To recharge your prepaid mobile, open the MobiKwik app, select the 'Recharge' option, enter your mobile number, choose your operator, and enter the recharge amount. Complete the payment to finish the recharge.

What is ZIP EMI?

ZIP EMI is an instant loan product that allows you to get an instant loan up to Rs 200,000* and convert your purchases into easy monthly installments, providing payment flexibility.

What is XTRA?

Xtra by MobiKwik is brought to you in partnership with Transactree Technologies Private Limited (“Lendbox”) which is a RBI-regulated NBFC - Peer to Peer Lending Platform.

Peer to Peer(P2P) Lending allows participants to lend and borrow money, cutting out the traditional bank in between.

What is LENS?

LENS is an account aggregator feature that helps you track all your expenses, income, bank balance and other financial details in one place, offering a consolidated view of your finances, and enabling you to make informed decisions.

What is MobiKwik Pocket UPI?

Pocket UPI is an innovation which allows you to make UPI payments directly from the MobiKwik wallet without having to link your bank account. Since Pocket UPI uses your wallet to make UPI transactions, it also helps to budget your monthly spending and helps keep bank statements clean. It is a secure, kwik, and convenient way to make UPI transactions.

Is my financial data safe with LENS?

Yes, LENS uses secure methods to access and display your financial information. Your data is encrypted, and we follow best industry practices for data protection.

What should I do if my transaction fails?

If a transaction fails, check your internet connection and ensure all entered details are correct. If the issue persists, contact our customer support for assistance.

How can I reset my password?

You can reset your password by selecting the 'Forgot Password' option on the login page and following the provided instructions.

How can I reach MobiKwik customer support?

You can contact our customer support through the app, website, or email. Visit the 'Contact Us' section for detailed contact information.

What are your customer support hours?

Our customer support is available 24*7. You can reach out to us at any time for assistance.