Benefits

Flexible Tenure

Easy Repayment Options

Get money in 30seconds*

Use as you go

0 Down Payment

Steps to take loan

Steps to take loan:

1Signup with your mobile number on the MobiKwik App.

2Complete your verification by entering your PAN, Aadhaar, & video KYC.

3Check & confirm the offered loan amount.

4Verify your bank account details where you will receive the money.

5Setup mandatory EMI auto-debit via NACH.

6Congratulations! You are all set to withdraw your loan amount.

Documents Required

Keep PAN card handy

Keep your Aadhaar number handy

Your mobile number should be linked with your Aadhaar or Central KYC registry. The same number should be used to signup

Your selfie as a photo proof on a clean/white background

Here’s what people are saying about us

Loved the process. I got the amount instantly in my bank account. Video KYC process was so smooth.

from our customers

Frequently Asked Questions

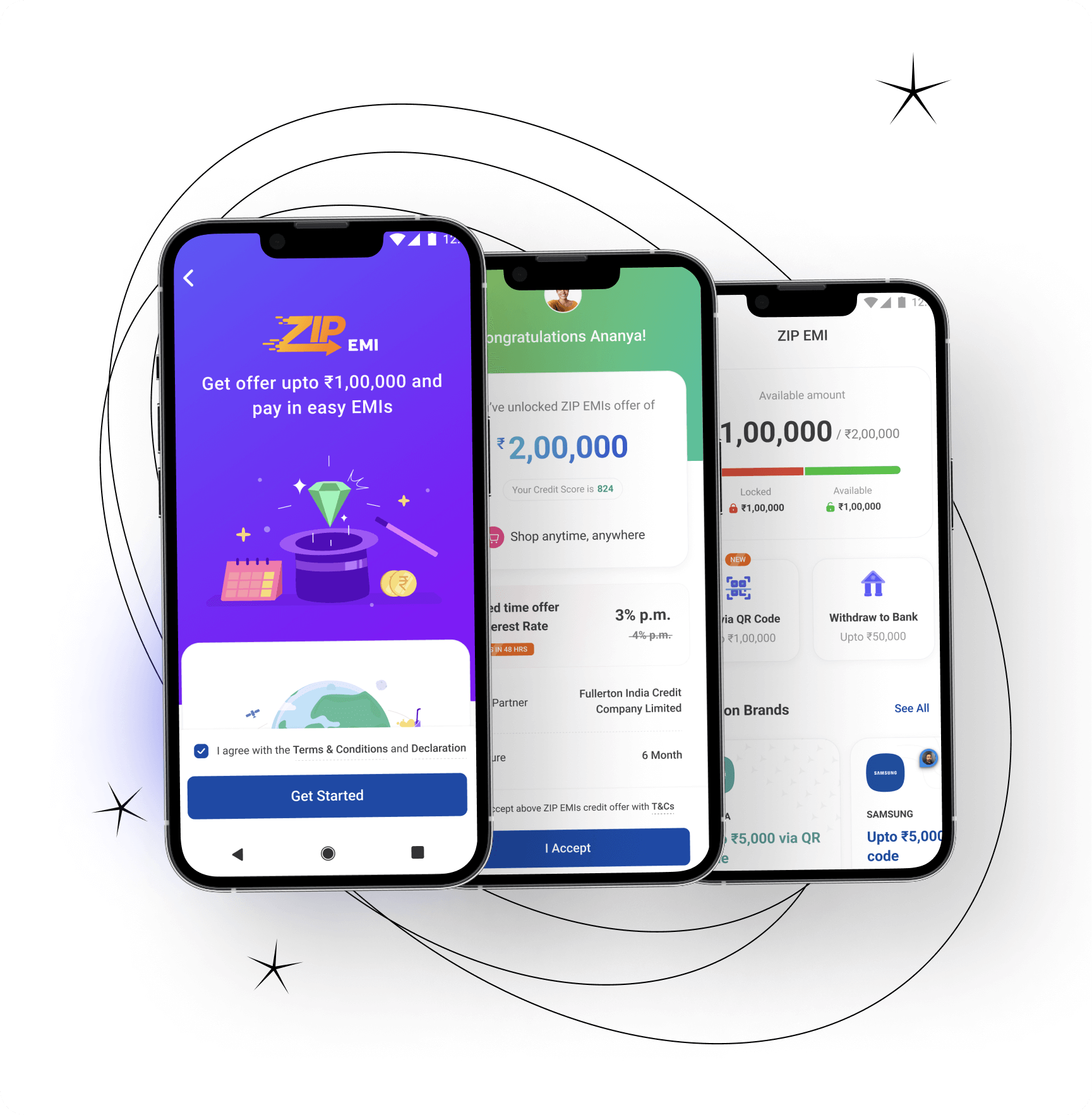

What is ZIP EMI?

ZIP EMI is a credit line of upto 5 lakhs offered by our lending partners where the amount can be withdrawn to your bank account with repayment tenure of upto 24 months.

How can I get ZIP EMI?

Go to ZIP EMI from the homescreen and complete the onboarding journey to check your eligibility. Accept, withdraw and pay in easy EMIs upto 24 months.

Can I increase my credit line?

Our lending partners replenish the credit line after successful on time repayments or you can apply for a new credit line after expiry of existing credit line.

Representative example APR calculation

The minimum loan tenure applicable for Ashwin is 3 months but can be chosen to extend up to 36 months

In case Ashwin does not need the money, he can choose to cancel the loan at no cost by paying back the Principal amount of ₹2,00,000 within 3 days of withdrawal.

Post 3 days of withdrawal, Ashwin will also be able to foreclose the loan by paying a minimal foreclosure fee of 3% of Principle outstanding.

APR ranges from 17.99% to 35.99% p.a.

Tenure ranges from 3 months to 24 months.

Related Blogs

Benefits of Personal Loan for Medical Emergency

Protect Yourself from Instant Loan Apps Scam

A Quick Guide: Easy Steps to Get a Personal Loan in India

Disclaimer: MobiKwik is a loan aggregator and is authorized to provide services on behalf of its lending partners with the best deals.

Unit No. 102, 1st Floor, Block-B, Pegasus One, Golf Course Road, Sector-53, Gurugram, Haryana-122003, India.

Ph. No. - 080-69808320 (Monday to Saturday 9:00 am to 8:00 pm)